Get to know the Triple Top Pattern and Bottom Pattern in Trading

Get to know the Triple Top Pattern and Bottom Pattern in Trading

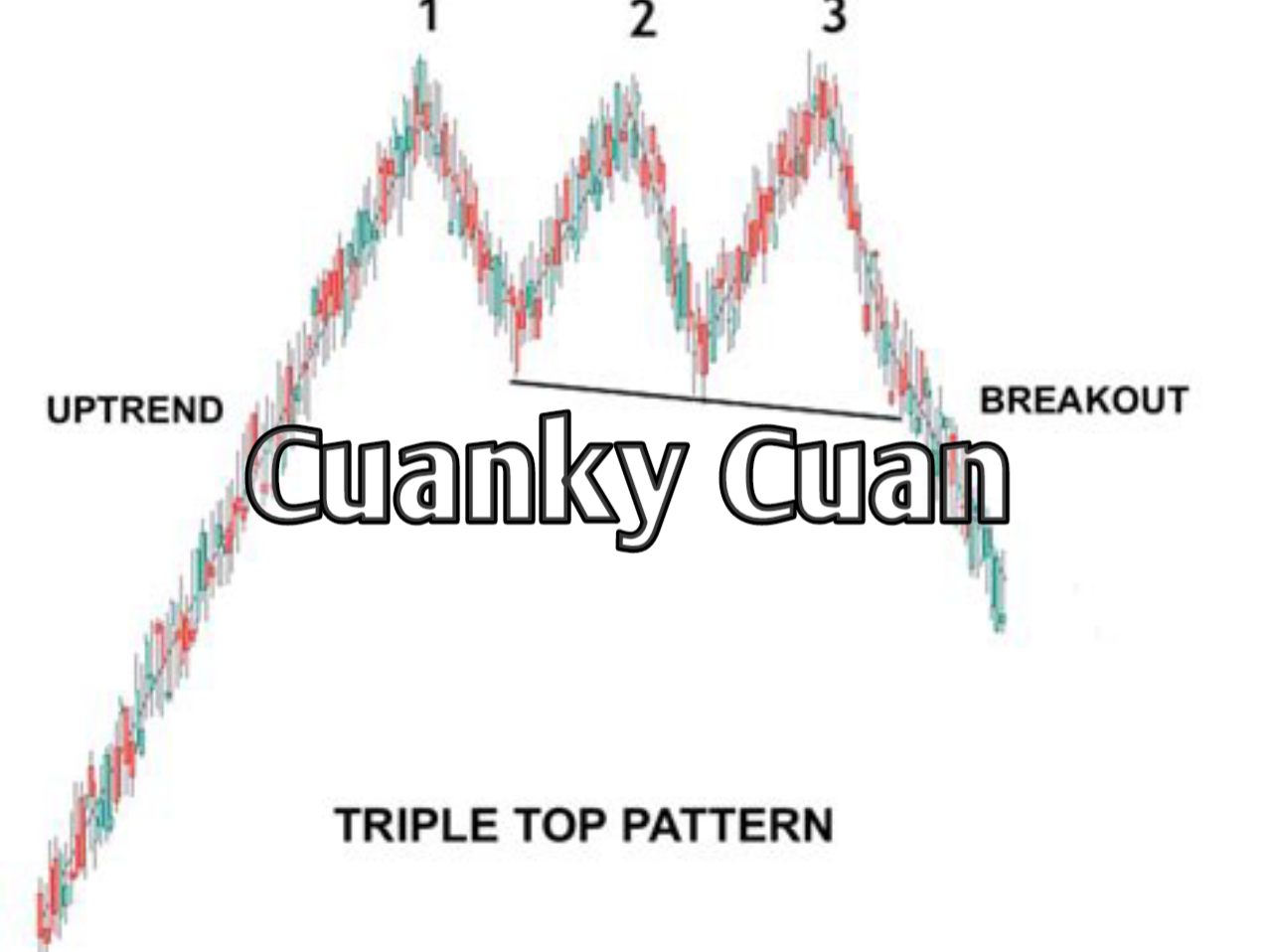

Cuankycuan.biz.id - Let's start with the Triple Top pattern. Imagine a scenario where the price of an asset reaches a certain level, encounters resistance, reverses downwards, and then repeats this pattern two more times. Essentially, the price fails to break through the resistance level three times, forming what appears to be three consecutive peaks of roughly the same height. This creates a pattern that resembles the shape of a triple top. It suggests that buyers are struggling to push the price higher, and a potential reversal to the downside may be on the horizon. Traders often look for confirmation signals, such as a break below a support level or a bearish candlestick formation, to validate this pattern before considering making a sell trade.

Also read: Why Don't Blockchain and Cryptocurrency Require a Central Bank?

Now, let's shift our focus to the Triple Bottom pattern. This pattern is the mirror image of the Triple Top, occurring at the end of a downtrend. In this case, the price reaches a certain level of support, bounces back upwards, and repeats this pattern two more times. The price fails to break through the support level three times, forming what appears to be three consecutive bottoms of similar depth. This creates the pattern of a triple bottom, suggesting that sellers are struggling to push the price lower. Traders keep an eye out for confirmation signals, such as a break above a resistance level or a bullish candlestick formation, to confirm this pattern before considering a buy trade.

These patterns are captivating because they provide traders with potential opportunities to enter trades at crucial turning points in the market. However, it's important to exercise caution and always consider other technical indicators and fundamental factors before making trading decisions. Patterns alone should not be the sole basis for entering or exiting trades.

Remember, my friend, successful trading requires a balance of patience, discipline, and continuous learning. It's essential to stay updated with market news, study price action, and refine your trading strategies. And most importantly, always manage your risks and never risk more than you can afford to lose.

Trading can be an exciting journey filled with ups and downs, but with dedication and a solid understanding of patterns like the Triple Top and Triple Bottom, you can navigate the markets with confidence. May your trades be profitable, my friend, and may the markets always bring you warmth and success!

Carrying out technical analysis on price charts is a mandatory thing that must be done in trading. This influences decision making to achieve targets. Where, technical analysis on the price chart itself will find out a pattern that appears as a prediction of future price direction. One of the patterns used to predict prices is the triple top pattern and triple bottom pattern.

Where, these two patterns can be used to adjust market conditions so that the analysis results can help you to gain profits even in trading in crypto assets. So, what exactly is meant by triple top pattern and triple bottom pattern and how do you use them in stock trading? Come on, see the complete explanation below.

What is the Triple Top Pattern?

The Triple Top Pattern is a technical analysis chart pattern that is commonly observed in financial markets, especially in stocks, forex, and commodities. This pattern is considered a bearish reversal pattern and is used by traders to potentially identify a trend reversal from an upward to a downward direction.

The Triple Top Pattern is characterized by three consecutive peaks at approximately the same level, forming a horizontal resistance level. These peaks are separated by two intermediate valleys, creating what appears to be three attempts to surpass a particular price level but failing to do so. The pattern can be seen as a reflection of the market's struggle to maintain bullish momentum and a potential exhaustion of buying pressure.

To identify a Triple Top Pattern, traders typically draw trendlines to connect the three peaks at the same resistance level. The confirmation of this pattern is often seen when the price breaks below the support level, which is drawn at the lowest point between the peaks. Traders tend to look for increased volume during this breakout, as it further reinforces the validity of the pattern.

Once the Triple Top Pattern is confirmed, traders may consider executing a short trade, speculating that the price is likely to decline further. The target price for the trade is often calculated by measuring the distance from the resistance level to the support level and projecting that distance downward from the breakout point.

It is important to note that the Triple Top Pattern, like any other technical analysis pattern, is not infallible and should be used in conjunction with other analysis tools and indicators. False breakouts can occur, where the price briefly breaks below the support level before quickly bouncing back above it. Therefore, traders often place stop-loss orders above the breakout point to minimize potential losses if the pattern fails to materialize as expected.

Furthermore, it is essential to consider the overall market conditions and the timeframe in which the pattern is identified. The Triple Top Pattern may carry more weight and reliability in a longer-term chart compared to a shorter-term chart. Additionally, other technical indicators such as moving averages, oscillators, and trend analysis can provide additional confirmation or divergence signals.

In conclusion, the Triple Top Pattern is a bearish reversal pattern that can potentially provide traders with insights into the market's sentiment and a possible trend reversal from upward to downward. Its identification and confirmation rely on the observation of three consecutive peaks at the same resistance level, followed by a breakout below the support level. However, it is crucial to apply comprehensive analysis and risk management techniques when implementing trading strategies based on this pattern.

Basically, the triple top pattern is a bearish pattern that forms on a candlestick chart after an uptrend occurs and tests the highest price three times before moving bearish. After the price reaches the third peak and falls below the neckline, it can be expected that the asset price will continue to fall until a trend reversal occurs.

Apart from that, the triple top pattern is a pattern consisting of three peaks appearing after an uptrend, thus giving a signal that the asset will not return to rising, and may even fall lower. Where, the triple top pattern with the first, second and third peaks at the same level and the neckline functions as a support level which is similar to the double top pattern or head and shoulder pattern.

What is the Triple Bottom Pattern

Meanwhile, the triple bottom pattern is a bullish reversal pattern to show a reversal in direction based on a downtrend to an uptrend. Where, this pattern begins with a downtrend or falling price, then three valleys appear in the same range, followed by a price break above the resistance level.

Additionally, the triple bottom pattern indicates buyers taking control of sellers' price action. This pattern itself is seen as three lows roughly bouncing off support, followed by price action breaking through resistance. The formation of this pattern is seen as an opportunity to open a buy position. The triple bottom pattern is also often preceded by a long downtrend with many sellers entering the market.

Meanwhile, the valley and first low are likely to be normal price movements. Then, the second low is an indication of an increase to gain momentum to prepare for a possible reversal. Meanwhile, the third low will show a support point and the price will bounce up until it breaks the resistance level. To understand the triple bottom pattern more clearly, there are at least several conditions, including the following:

There is a downtrend before the pattern occurs.

The three lowest positions or lows must be in a position with the same level.

Falling volume along the pattern is a sign that the downtrend is weakening and the price is entering a bullish trend when it breaks the last resistance.

How to Trade Crypto Using the Triple Top Pattern

To apply the triple top pattern in crypto trading, you must at least know that there is a pattern that can only be identified when the price moves to support in the second term. The steps that must be taken are as follows:

Watch for the Appearance of False Breakouts

To use the triple top pattern, you must pay attention to false breakouts which usually occur when the price forms a bullish breakout and then returns to the channel.

Checking Volume

The next step is to look at the volume trend in traded assets. Where, volume becomes an important part of price action transactions so traders must identify when things are forming and just wait for the price to move above the upper resistance level.

Placing a Stop Loss for Selling or Buying Actions

Then don't forget to place a stop loss above the resistance level. In this case, the buy stop trade is executed when the thesis is validated. That way, you can place a sell stop trade at the bottom of the triple–bottom downside. Where, this transaction will be executed when the bullish pattern display is invalid.

In fact, some traders trade channels that exist before a bullish trade appears or by going short when it hits resistance to buying when it moves to a support point.

How to Trade Crypto Using the Triple Bottom Pattern

Meanwhile, trading using the triple bottom pattern can only be done in an open buy position because it shows a bullish reversal or reversal from downtrend to uptrend. For more details on using the triple bottom pattern in trading, including the following:

Ensure that the trend is bearish or downtrend before a formation is formed.

Ensure that the arrangement of the 3 valleys is in the same price range.

Draw a horizontal line between low 1, low 2, and low 3.

Draw a horizontal line between resistance 1 and resistance 2.

By carrying out these steps, you can open a buy position when a candle appears that closes above resistance 1 and resistance 2. Then place a stop loss at the bottom of low 1, low 2, and low 3. Apart from that, also place a profit target which refers to the distance between the low and the resistance level.

Basically, using the triple top pattern and triple bottom pattern is part of the way to make profits in crypto trading. Therefore, further understanding is needed if you want to use this pattern for successful trading. Apart from that, also understand the conditions that occur in the market to adjust which patterns are suitable for use when trading.

For those of you who are just starting to invest or trade in crypto assets, apart from increasing your knowledge and understanding of this matter, it is also important to choose a platform that helps you get crypto assets. Currently there are many platforms that can help you invest in crypto assets safely and easily, one of which is through the Crypto application.